Current state of storing, restoring and bequeathing crypto assets / wallets

If you have been in crypto for a while, you will no doubt have heard the term “Not Your Keys, Not Your Coins”. It’s essentially a view, adopted mostly by “Bitcoiners”, that encourages users to hold their own private keys (for Bitcoin) instead of entrusting the keys to a third-party i.e. a Crypto Exchange.

It may seem folly now given the increasing number of custody solutions that now exist in crypto - many of which are insured (somewhat). Many have lost their Bitcoin/crypto due to exchanges being hacked or going down, etc - more-so back then than now, although even in recent memory there have been a few such cases.

The custody vs non-custody is something that I, like many, have no doubt spent some time thinking about. Estate planning is another major one for me. To everything, there is a pro and a con, including how to store your crypto.

Storing crypto keys is, fundamentally, a key management issue - which relies on ones own operational security for storing ones wealth. And if cyber security has taught us anything, it’s that passwords suck and people still suck at creating and/or storing passwords. This is despite important initiatives such as Password Managers (which everyone should use).

Placing such a huge responsibility on users to keep their keys safe is….no small feat. Quiet frankly, I’m of the opinion that most users should choose trusted custody solutions (ironic given that crypto is about “trustlessness” or more aptly - trust-minimization).

Current state of key management

I won’t focus on the cold vs warm storage of crypto in this post. I will focus rather on core issue of said storages, mainly the “non-custodial” key management component from the view of a normal (even advanced) crypto user/hodler/investor, etc.

There has been much improvement in the key management front over the past few years within the crypto ecosystem.

Vitalik wrote a much recommended post on the current state, and can be boiled down to:

Hardware wallets (private keys)

Mnemonic phrases

Mutlisig*

Social recovery

The problem with the first 2 is that you have to write down and safely store these private keys / mnemonic phrases. You create a crypto wallet - you are asked to write and safely store your mnemonic keys. Ditto when buying a hardware wallet.

One solution is ofcoz to store your mnemonic phrase / keys in a bank vault as many have done. And the hardware wallet while at it. This works.

On the social recovery, I won’t rehash what Vitalik has already written about (read it).

Multisig is another great solution, which I personally use for some wallets. There is gnosis, Unchained Capital Vaults, Casa and a bunch more.

courtesy of Unchained Capital

The basic idea is that no one key can spend your funds. In the case of Unchained Cap depicted above, one has two options:

Client controlled - you control 2 of your keys and their control the third

Multi-institution - you only control 1 key, Unchained and another institution controls the other 2

I’m in favor of multi-institution, as opposed to client controlled (controlling 2 keys). But in either case, if you manage to loose your keys, Unchained/Casa, etc would be able to help you. It’s a sweet setup in that even if the companies go bankrupt or cease to exist, you can still recover. That is sweet!

Forget keys?

Multisigs are clearly the current better way to securely store your crypto, but what if there was an even more frictionless solution? We always talk about mass crypto adoption, and I don’t know if we can have that with the current friction of multisig solutions.

The way I see it, when the mass adoption happens, it will mostly be via custody solutions i.e. Exchanges, etc. And the security of these has improved over the last few years, with many being regulated (e.g. some in the United States). That’s just my opinion.

But more on the side of self-custody, what if you could have the security of multisig without private keys, mnemonic phrases? Wouldn’t that be even sweeter?! Well, such a solution does exist - enter ZenGo’s threshold sigs* (Note: I’m not shilling ZenGo, I use it too as with other discussed solutions. I just find their approach pleasant)

Courtesy of ZenGo : https://zengo.com/safety/

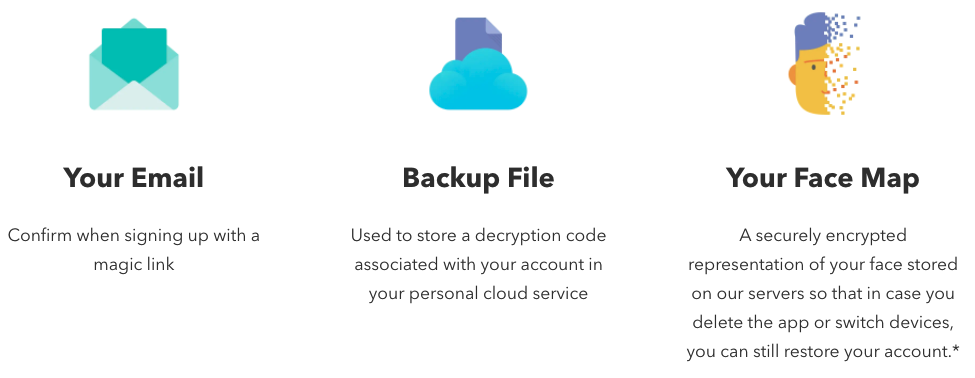

ZenGo wallet allows you the security of multisig (or rather, threshold sig*) and using the same workflows we are all accustomed to - email + cloud service + facial biometrics (FaceID, etc). One doesn’t have to bother with keys. Better still, they also have in place a solution to be able to recover your wallet should the business go under, similar to other entities that provide multisig.

This “keyless” security process is sweet. This is by far the most frictionless wallet that comes with as equally strong security guarantees. I’m excited to see more frictionless wallets in the market for the average user.

Estate planning

Death is inevitable (at least as far as I’m aware!). For most of us, the ideal situation is to leave our crypto assets for our loved ones when we pass away. Typically, one would have a last will and testament which stipulates what is to happen to your estate…..but with crypto, you could stipulate what is to happen, but how it is to happen is not so clear. At least not clear enough how to do it securely.

So here are a few ways I know of to date (please let me know if there are others I’m unaware of):

Requesting from Exchanges

The easiest solution is if one uses a custodial service (.e.g crypto exchange). In this case, alot of crypto exchanges have an overview of what needs to be provided to them to release said crypto assets belonging to your departed loved one. e.g. here is what Coinbase would require:

Death Certificate

Last Will and Testament - AND/OR - Probate Documents (either Probate, Letters Testamentary, Letters of Administration, Affidavit for Collection or Small Estate Affidavit)

Current, valid government-issued photo identification of the person(s) named in the Letters Issued

A letter signed by the person(s) named in the Probate Documents instructing Coinbase on what to do with the balance of the Coinbase account

Other crypto exchanges will have more or less similar requirements. Seems straight forward enough.

Password Manager Emergency Access

My favourite password manager, Lastpass, has an Emergency Access feature which is perfect for estate planning. It allows you to grant a one time access to your Lastpass Vault to a nominated person/s. This will give them access to everything in your vault (passwords, notes, credit card details, etc). It also allows you to set a timed delay for when your nominated person/s can access your vault. So you can set your Emergency Access and send to wife, husband, brother, sister, etc and set the time frame to be e.g. 6 months. The nominated person can request access, but while you are still alive, you can simply deny that request (Lastpass will alert you). If you don’t deny it, the nominated person still won’t have access until the time frame set (e.g. access will only be granted after 6 months, provided you haven’t denied the request)

So this is actually super cool and I wonder how many people are aware of this and have planned accordingly. So, this Emergency Access will work, in respective to crypto, for your loved ones to have access to your crypto exchanges and hopefully login and withdraw your assets. Or if you stored your private key / mnemonic phrases in your secure notes on Lastpass, then can simply use that to restore your non-custodial wallet and access your assets.

But why store your mnemonic phrases in Lastpass? What if it gets hacked?? Well, that threat is real, but other things you can do is enabled 2FA (obviously) but you can also choose to allow access to your Lastpass from specific IP geolocations (e.g. even if my Lastpass credentials are hacked and my 2FA device compromised, the attacker will only be able to login to my Lastpass from the U.S.A IP space. if they try login from China - access denied!)

Multisig inheritance

As discussed above, the multisig solution is quiet neat. In fact, one such multisig provider has such a solution - Casa Covenant, a Bitcoin inheritance solution. The catch is you must use one of their higher premium multisig packages (Diamond and Platinum). In a typical 3-of-4 multisig setup, Casa Covenant adds a sixth key - the Inheritance key, which can be given to your estate lawyer.

Unchained Capital, another good multisig provider, has a similar service as well and I have no doubt a few more will spring up in the coming years.

“Keyless” hackery i.e. the ZenGo + Lastpass way

Another “hackey way” is to use a combination of ZenGo and Lastpass. So I have already explained Lastpass Emergency Access, so that could be paired with ZenGo so that you don’t have to store keys / mnemonic phrases on Lastpass.

ZenGo, keyless and mnemonic-less custodial wallet, allows for the addition of a second Face map in your wallet (i.e Face map of your loved one)

Now, the caveat is the assumption of the device still being in your possession. If the device gets stolen, then we have to move to step two:

ZenGo allows for the backing up of the face maps to your chosen Cloud service. With the LastPass Emergency Access, your loved one, whose face map is added in ZenGo, will have access to 3 factors needed to restore your wallet - email account, the backup file and their face map.

Wait, what?

I did say this was a ‘hackey way’ to try recreate something which doesn’t require the storing of private keys / mnemonic phrases :-)

CryptoWill protocols (decentralised, on-chain wills)

There is research on cryptowill protocols - which are decentralised and on-chain self-sovereign cryptographic wills for bequeathing cryptocurrencies, without relying on any third parties. This protocol will ideally have:

updatability - as the owner of the cryptowill, you can update the will anytime before death

guaranteed access and privacy-preserving - beneficiaries should only learn of their entitlement after your death

robustness - if the protocol relies on mediators, it must be robust against any malicious mediator

The scheme and cryptographic setup of this protocol is laid out in the above mentioned paper. Give it a read if you can stomach the maths - but even if you can’t, I still reckon it’s worth a read!

Conclusion

I think I covered most of the things I wanted to cover in this post. As you can see, alot of ground work has been done, and more will be in the future. No doubt other things already exist which I don’t know or know but forgot to include in this post. We live in interesting times, and I’m looking forward to what is to come.

*this post won’t be going into the technical details of these concepts